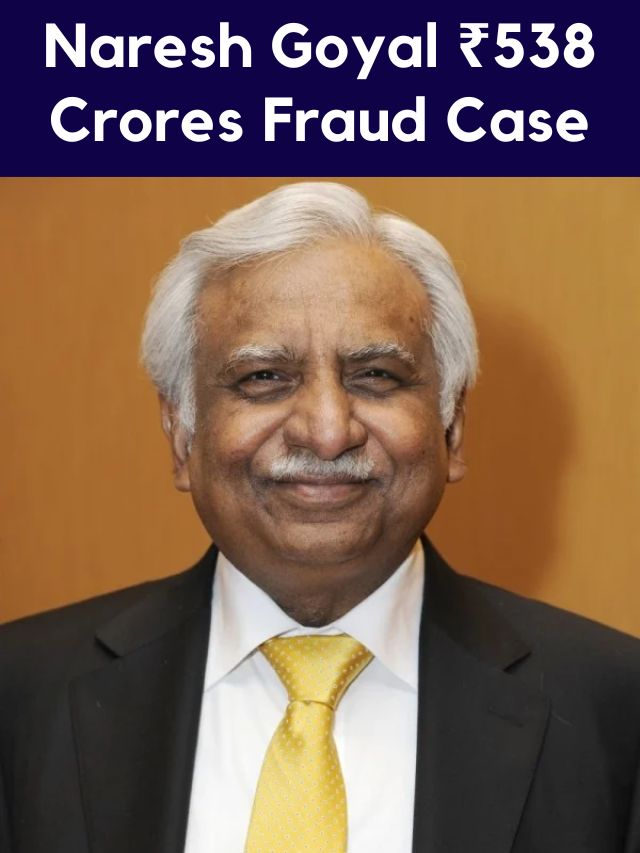

In a startling turn of events, Naresh Goyal, the founder of the now-grounded airline Jet Airways, finds himself at the center of a high-profile fraud case. Goyal’s arrest by the Enforcement Directorate (ED) on September 1, 2023, in connection with an alleged fraud of ₹538 crore against Canara Bank, sent shockwaves through the aviation industry and beyond. This article delves into the details of the case, Goyal’s judicial custody, and the key arguments presented by both sides.

The Arrest and Judicial Custody

On September 1, 2023, Naresh Goyal was arrested by the ED under the Prevention of Money Laundering Act (PMLA) after a lengthy session of questioning at the central agency’s office in Mumbai. Following his arrest, he was produced before a special PMLA court, which sought his judicial custody. Subsequently, Goyal was remanded to judicial custody for 14 days. This decision led to his transfer to Arthur Road jail in Mumbai, a move that has raised significant concerns given his health condition.

Health Concerns and Pleas

Goyal, 74 years old at the time of his arrest, has been grappling with several health issues, which prompted him to file multiple pleas during his time in custody. His requests included regular medical check-ups by his family physician, access to a personnel specialist doctor, and permission to meet or call his family members daily, particularly his wife, who is battling cancer. His pleas emphasized the critical nature of his health, citing a history of heart disease, bypass surgery, and a significant blockage in his left main artery.

The ED’s Allegations

The ED has accused Goyal and Jet Airways of defrauding Canara Bank to the tune of ₹538 crore. The agency’s investigation uncovered a complex web of financial irregularities. Jet Airways obtained a loan from a consortium of 10 banks to cover operational expenses between 2011 and 2019. However, many of these funds remained outstanding, leading to further scrutiny.

A forensic audit revealed that ₹1,152 crores were diverted under the guise of consultancy and professional fees, with an additional ₹2,547.83 crore shifted to a sister concern, Jet Lite Limited (JLL), to clear its loans. The ED also alleged that ₹9.46 crore had been disbursed to family members and domestic help working at Goyal’s residence.

Also Read – Jawan Box Office Collections

Goyal’s Defense

Goyal’s defense team, led by advocates Abbad Ponda, Amit Desai, and Amit Naik, vehemently argued that Goyal did not have any loans in his or his family’s name nor stood as a guarantor for them. They contended that the funds obtained by Jet Airways from banks were standard for the aviation sector’s operation and should not be classified as money laundering. Furthermore, they highlighted the crisis in the aviation industry, which they claimed had forced Goyal to default on some repayments.

The Naresh Goyal fraud case involving Jet Airways continues to be a major talking point in India’s legal and business circles. As the case unfolds, it raises questions about corporate governance, financial transparency, and the health of the aviation industry in the country. With Goyal’s judicial custody extended for 14 days and further investigations pending, the future of the case remains uncertain.